Published on 08/02/2016 | Strategy

Internet of Things (IoT) is a network of things connected to each other and refers to an ecosystem comprising of objects, connectivity and application/services. There are a number of projections on the size of the market by 2020 and the projections vary significantly but all projections agree to a minimum of $1 trillion plus addition to economic activity due to IoT. This is a big number and driving almost every company (even remotely related to IoT) to encash the IoT hype.

Given the interest in Internet of things and the challenges in this space, the importance of business models and partnerships cannot be over emphasized. It is important that the industry works together in partnership to achieve the industry goals. However, it is equally important for the various entities to realize who will be best positioned to lead the partnership. I will start with the value chain to arrive at the appropriate business model for IoT which would need to be based on partnerships and collaboration.

Telecom Circle | Mohit Agrawal | May 3, 2016

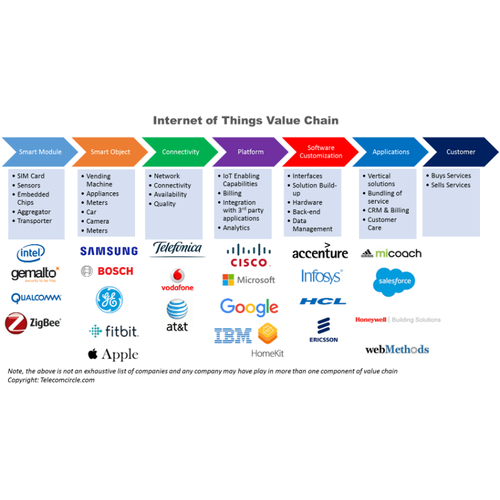

The value chain is perhaps the most important part of the business model. It defines how the service is delivered. IoT has a very complex value chain due to the fact it impacts a large number of processes. The large opportunity also means multiple stakeholders who would need to work together to deliver on the promise of IoT. Below is the simplified version of the value chain listing down the key activities under each component of the value chain and a few players active in this space (the list of players is indicative and not exhaustive).

Clearly, the partnership formation is not easy when each of the entity would consider itself more important than the other. In such a scenario, the most important question for any company interested in IoT is to find its position in the value chain. The position in the value chain would define its relevance, strategy and opportunity. The big question is who will win or lead the IoT. The player capturing the biggest pie of the value chain should ideally take a lead in forging partnerships. A quick look at the value that can be targeted by different players (refer to the image below), it is clear that the platform providers are best positioned to lead the IoT as they capture up to 50% of the value. However, capturing the largest value share would not make them an automatic choice and competing claims would continue to fragment the IoT market.

There are five key groups of players, viz., device providers, operators, platform providers, systems integrators and application providers. Each of this group would have various companies depending on the target industry. Each of the player brings unique strength to further the IoT but not everyone is on an equal footing. An analysis below shows the relative strengths (or weaknesses) of each group of players which will help evolving the business model.

Device Providers : They capture up to 10% of the value but can they develop service based model for IoT? If they are able to do so, then they have the ability to capture another 10-20% of the value. Without a service model, they will benefit from the hype around IoT but they will remain just a vendor. Best bet for them is to enter into non-exclusive partnerships with the lead player. Players like Nest are attempting to lead into the platform and app provider domain but this approach risks evolving a proprietary solution.

Operators : The operators are very critical as they provide the connectivity and have had a head start over others with M2M. It is natural for them to consider themselves as frontrunners. However, I do not believe that the network providers that can connect the most devices will win not only the network value but are also best positioned to garner downstream value. In my opinion, the operators do not have it in them to lead the IoT space as they find it difficult to think beyond connectivity and ARPU. The operators still have not learnt solution selling/ managed services. Operators need to embrace the start-up culture as IoT business is moving very rapidly and is unlikely to wait for the internal bureaucracies. The mindset of an operator is based on a stable business environment (remember an operator gets over 80% of revenue from annuity business) and is unlikely to go too far on risky ventures. They need a partner to go to market and are unlikely to play leading role in any IoT partnership/alliance. IoT will drive greater data usage but due to commoditization, connectivity is at risk of becoming the ‘non-value’ add component of the value chain. The risk of operators being reduced to just the pipe to the cloud is very real.

Platform Providers : Platform is the heart of IoT and bring together the hardware, the connectivity, service providers and the vertical applications to provide industry specific IoT solutions. Most of the serious players are eyeing to become platform providers but the success would depend on their ability to forge partnerships and drive towards common goal.

IoT platform is perhaps the most misunderstood terminology in IoT. There are different kinds of IoT platforms like the connectivity/M2M platform (primarily focused on connecting the devices via telecom networks/SIM cards without much focus on analytics or data processing), Hardware specific IoT platform (these types of platforms are most likely the proprietary platforms developed by device vendors, e.g. Nest) and Pure IoT platforms (platforms that have been specifically developed for IoT keeping the scale, standards and requirements in mind). Not all kinds of platforms would have the ability to lead the IoT effort. The winning combination is a platform that offers device management, cloud based storage, analytics, data visualization and ability to integrate with 3rd party systems via API or SDK to be able to take advantage of legacy systems as well as wide variety of other IoT hardware and software.

System Integrators : They have a big role in the industrial internet of things. Not everything is plug-and-play out of box and hence we need system integrators to make the individual components of IoT to work together in the most optimal way for the customer. The best option for the system integrators is to identify their niche and enter into partnerships with large platform players.

Application Providers : They are too small a player and cannot carry the partnerships on their own. In fact, I see them as perfect acquisition targets by serious IoT players to capture bigger pie of the value chain. Very few industry specific large application providers are likely to operate independently.

No one provider has an end to end IoT solution yet and hence the only choice is to partner or perish. The platform providers seem to be well placed but will need the partnerships to fully realize the potential of IoT. Device makers and operators would need to partner with platform providers and vise versa to ensure that they are not left out of the IoT ecosystem.

Link: http://www.telecomcircle.com/2016/05/internet-of-things-business-models/