Published on 09/30/2017 | IoT Index

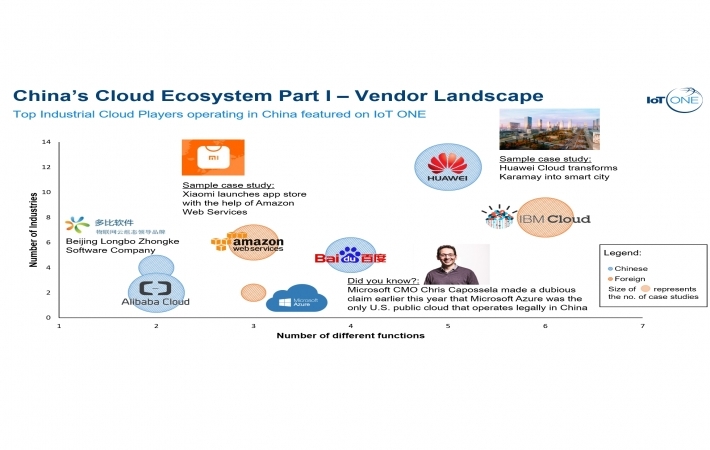

Interest and competition in cloud computing in China has been intensifying in recent times and hence we felt it would be timely for us to do a series on this topic. This week we will focus our attention on the players shaping the cloud ecosystem in China.

On Sept. 5, Huawei Technologies Co Ltd announced a strategic partnership with Microsoft Corp. The deal will allow Microsoft to put more apps on Huawei's cloud and is seen as a move for the two companies to consolidate their grip on the Chinese market. This is just one of the many developments taking place in the Chinese cloud market as companies jostle for dominance.

The cloud vendor ecosystem in China can be broken up into four main categories:

The "Big 3"

These are the three state-owned operators namely: China Telecom, China Unicom and China Mobile. Their cloud strategies are very much aligned with state policy, acting as enablers of the Chinese government's 13th Five-Year Plan (FYP) focusing on developing cloud computing and Industrial IoT. China Telecom recently won a bid to provide an IT information city in the third-tier city of Liaoyang for as little as RMB 0.01, sparking allegations of price distortion and unfair competition. This will be covered more in the subsequent weeks when we focus on the political element of cloud computing in China.

The "BAT"

These are the three biggest Chinese technology companies: Baidu, Alibaba and Tencent. Though these firms are not technically state-owned, they are so entrenched in Chinese society that they are too big to fail and hence enjoy a privileged relationship with the Communist Party. All three of these tech giants have cloud offerings although Alibaba cloud is the most mature of them and is a market leader alongside AWS and Microsoft in China. Their cloud is also the best-suited of the three for use in Industrial IoT applications.

Other Chinese ISVs and SIs

Besides the "BAT", China's domestic cloud sector is also expanding rapidly. Notable big players in this field include companies like Huawei and who have spearheaded numerous IoT and smart city initiatives that are heavily reliant on their strong cloud infrastructure. The country’s cloud computing industry reached a market size of 150 billion yuan ($22 billion) in 2015, and is expected to worth 430 billion yuan by 2019 and much of this growth is driven by these mid-sized companies.

The Foreign Companies

Lastly we come to the foreign players who are also no pushovers in China. While, many foreign cloud and software companies generally face difficulties entering the Chinese market due to strict government regulations some notable players like AWS, Microsoft and IBM have managed to leverage their maturity and deeper technical knowledge over their Chinese counterparts to gain immense success.

In fact, much of the rivalry seems to be focused on their fellow foreign companies themselves as they seek to outdo each other and claim top-spot as the leading foreign brand in the Chinese market. In fact, Microsoft CMO Chris Capossela raised a few eyebrows earlier this year with a claim that Microsoft Azure was the only U.S. public cloud that operates legally in China on the basis that they have a joint venture with a local partner (21 Vianet) that is recognized by the Chinese government. However AWS and IBM both shot back defending their legitimacy by saying that aside from their partnerships with Beijing Sinnet and Wanda group respectively that they also work with Microsoft's partner 21 Vianet.

Conclusion:

China's cloud market is still considerably small compared to other leading markets. Alibaba Cloud's Global GM Ethan Yu conceded that the Chinese market is still a few years behind the U.S. but points to the fact that the growth potential is undoubtedly massive. The top dogs and smaller players alike will continue to compete as new developments and trends continue to shake up the complex Chinese cloud ecosystem.