Published on 11/03/2016 | Technology

Industry 4.0 is a term referring to the fourth phase of industrial innovation that is underway now. The term "Industrie 4.0" originates from a project in the high-tech strategy of the German government, popularized in the Hannover Fair, 2011. I refrain from using the word "revolution", and prefer "phase" since technological progress is continuous, and it is the culmination or confluence of a set of technologies that marks a new phase rather than a sudden step change (as in "revolution"). The first (Industry 1.0) phase or the original industrial revolution involved mechanisation of production through water and steam power.

The second (Industry 2.0) phase involved the invention of the production line, electric energy, and finer division of labor. Introduced by the Cincinnati slaughterhouses in 1870, the concept took life with Ford's popularization in the Model T production. Black was the only color the Model T came in from 1914 through 1925, and the reason was economics, not style. Black was the only color paint that could be dried quickly, and speed was important at the Ford plant because of its enormous volume. In 7 of 19 model years, other colors - green, bright red, dark blue, brown, maroon and gray - were available. Industry 3.0 was the age of computerized controls, with the introduction of programmable logic controls (PLC). Emergence of enterprise resource planning (ERP) software helped automation of a variety of enterprises (not just manufacturing).

Industry 4.0 is driven by accelerating digitization enabled by sensors that are ubiquitous, multi-modal & networked throwing off huge data volumes, the emergence of real-time big-data analytics that can fit into control-loops or supervisory controls, new forms of human-machine interaction such as touch interfaces and augmented-reality systems; and linking the outputs of sensing/analytics to new forms of actuation touching the physical world: next generation robotics and 3-D printing.

Cognitive IoT is the use of cognitive computing technologies in combination with data generated by connected devices and the actions those devices can perform (Hat tip: Sky Matthews' article, and Harriet Green's article).

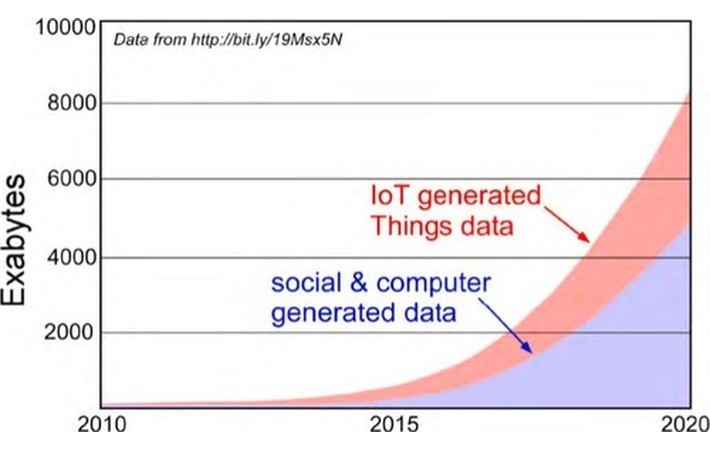

Cognitive IoT starts from digitization enabled by IoT and the need to manage tons of IoT generated data, largely unstructured, multi-modal and growing really fast (see below). This requires a foundation of robust and scalable data management technologies. The next challenge is that today a lot of sensor data is simply thrown away or is "dark" i.e. not really utilized, or stuck in single-purpose silos (where its productivity is limited).

Just like Industry 4.0 is a fourth phase in industrial evolution, cognitive is coincidentally a fourth phase in the evolution of computing.

Consider the human analogy: a human senses via multiple intuitive sensing modes (eyes, ears, touch etc), processes the information intelligently in the brain, makes decisions, responds via actuation, and learns with experience. Similarly the components of a cognitive computer are captured by the acronym: iURL

Rich natural interfaces between people and things (with people via HCI (voice, visual etc) and things via IoT)... a.k.a "Interface" (i)

Ability to process and integrate insights from multi-modal unstructured data (text, voice/audio, video, time-series, spatial data etc) ... a.k.a "Understand" (U)

Reason over the data, present the insights for decision makers via natural interfaces, and/or make decisions & actuate controls ... a.k.a. "Reason" (R)

Deeply learn over time, experience and use cases. ... a.k.a. "Learn" (L)

The URL components above are associated with advances in Artificial Intelligence (AI). Cognitive involves a pivot from "compute-centric" to "data-centric" thinking and architecture. It also implies a pivot from "programmed" computers to "learning" computers. Note that Cognitive IoT is a journey from where computing is today into the future. Specific iterations of the solutions will have subsets or different levels of the capabilities above. Though Cognitive IoT is a term from IBM, I am using it to describe the class of significantly AI-enriched solutions for Industry 4.0 and IoT in the industry.

A lot has been written about how an IoT/ connected or "smart factory" can raise productivity. Optimization of the assembly across departments is an important example. Even within a single department, the fusion of multiple modalities of sensing (eg: vision technologies that take in camera feeds, and fuse them along with machine sensor feeds) can help better optimize individual processes. In this article, I will not discuss this important aspect much since it has been extensively covered in popular literature. I'd like to focus on opportunities beyond the boundaries of the organization downstream and upstream in the value chain.

There is an important consequence of Cognitive IoT: it blurs the line between manufacturing and services. IoT in general enables visibility. Now that visibility can go beyond the boundaries of the organization upstream and downstream into the value chain. Lets consider the downstream opportunity first: sensing and re-configurable actuation embedded in products gives visibility and enablement of services post-sale, and allows for rich interaction by the manufacturer in the context of the customer. Lets illustrate this with a case study:

Case Study of Tesla: Is it a manufacturing company or a services company?

Consider Tesla, who manufactures electric vehicles, but has built a brand by owning the customer experience. This raises a rhetorical question: Is Tesla a manufacturing company or services company?

Clearly Tesla is a manufacturing company as of now. But, its service content is growing rapidly. The company uses its own distribution (eg: showrooms a la Apple stores) unlike other automakers to control the sale experience. The car is designed (thanks to EV technology) to require lesser service than traditional ICE vehicles. Tesla also delights customers via customer service at every touch point, and makes the vehicle better over time via such remote upgrades. First, the in-car touch point with the consumer is a HUGE Ipad-like dashboard in the car, synched with the customer's mobile phone. Local sensing of every aspect of the asset health and operations in the field gives unprecedented visibility to Tesla of their fleet of cars. For example, the management of the cells in the battery pack helps maximize its lifetime and utility. Locally on-board computers can reconfigure innumerable aspects of the car, via remote upgrades similar to a mobile phone.

All this makes it a "smart" car or a "smart product". But it gets even better. Your manufactured products can take a life of their own, and become "living products".

One fine day, Tesla owners woke up and found that their cars had been upgraded to have a suite of autonomous driving (autopilot) capabilities! Pause to think of this. Auto-pilot is a non-trivial capability that magically showed up in the entire fleet of cars, post-sale, enabled by software & actuation, and activated remotely. Similarly, sharing locally sensed information in the cloud allows machine learning software to not just learn from the issues with one vehicle, but learn using data across the fleet of vehicles. This allows continuous incremental updates of capability and to fix faults in the field, remotely via software, not just in one car, but across the field. Again, this reduces the need for re-calls, simplifies car service (also in part because there are fewer key components, and all are mostly orchestrated by software).

Tesla also owns and operates a network of super-charging stations on freeways, and partners with hotels and other institutions to operate a larger network of destination charging stations. With its purchase of SolarCity, a solar-as-a-service company (which also will soon manufacture solar panels), Tesla will move a lot more into services. These services offered by the manufacturing company will blur the boundaries between multiple industries: energy and automotive/transportation. For example, the bundle of energy storage capabilities in the EV and stationary battery, and the timing of charging can be orchestrated as a function of grid conditions, solar production etc. Moreover, an aggregate of such assets can be used to provide grid balancing / ancilliary services.

Tesla in its new master plan, part Deux, outlined a vision to move from being an (electric) auto manufacturer to a service provider managing a fleet of EVs (potentially competing with Uber), solar PV systems and storage to provide compelling mobility, EV experiences and renewable energy services. It proposes to draw upon the financial structuring, and investment in marketing assets (eg: show rooms) across Tesla and Solar city. Its EV-as-a-service, solar-as-a-service, storage-as-a-service, shared mobility options and transcending boundaries between energy and transportation taking advantage of depreciation characteristics, and sophisticated remote management / autonomy features. Recently SolarCity announced a "Solar Roof" product, likely to be offered as a service. So your roof when you replace it will be a service ! (see companion articles for more: Service vs Asset-as-a-service... , Tesla Model 3: ... Ushering in the Energy-transportation nexus, Solar + Ola! = Sola! ..., and How Electric Scooters, ... can spur adoption of distributed solar in India).

Even if a manufacturer does not integrate so far downstream, some of the downstream service opportunities can be cherry picked. Daimler subsidiary Car2Go runs a car-sharing-by-the-minute operation in several cities, essentially transforming from a automaker into a transportation provider. For example, fleet management and condition-based maintenance. Auto Major Mahindra & Mahindra has tied up with taxi aggregator Ola! in India to offer a package that includes Mahindra cars at special prices, attractive financing with zero down payment, and the best NBFC interest rates, subsidized insurance premiums, comprehensive maintenance packages, as well as exclusive benefits on the Ola platform. Similarly Mahindra has floated a startup subsidiary Trringo to offer tractors-as-a-service to farmers in India. Ultimately, this can link up with precision digital agriculture services.

IBM helps Kone (a Finnish Lift and Escalator manufacturer) manage a global fleet of assets, analyze condition to optimize service, and learn across the fleet. Whirlpool and IBM are collaborating on managing a fleet of appliances to improve appliance performance, optimizing supply chains, and personalization of services to consumers (eg: ordering consumables like detergents on e-commerce sites automatically). Local Motors and IBM are jointly marketing Olli, an autonomous transportation solution for metros, campuses, and local areas (see article: Meet Olli ...). Along with joint marketing, the distinctive features of the partnership are voice-based natural interfaces with humans, 3D printing of the Olli body, and autonomous navigation and intelligent fleet management driven by a package of sensors.

Beyond as-a-service and service revenue streams, even the data generated by these interaction, and fleet learning from sensors, can be monetized in several ways. Advertising, product placement at the point-of-customer-interaction is one obvious way once you have created a delighted customer. Moreover, engineering data and insights can also be monetized to partners or used within the corporation to design / customize products. Consider retailers. A retail store bristles with embedded technology. It’s blanketed with unobtrusive video cameras. Sensors on merchandise and shelves are hooked up to the network—as are shoppers who have agreed to be connected via smart phone apps. Audio speakers facilitate two-way conversations with people and gather information about what’s being said. A cognitive system combines all of this sensor data with information gathered about the local weather and news, social networking streams, and sales trends. Further, the retailer's insights into customer behavior in store, learnt over a range of sensors, can be used for internal merchandizing, product placements and deals with suppliers, and monetized for product design by supplier brands.

Industry 4.0 enabled by Cognitive IoT technologies is allowing the manufacturing process to evolve from Build-to-Stock (eg: McDonald's model) to Build-to-Order (eg: Subway restaurants). McDonald's builds burgers that are standardized (with some customization), whereas every aspect of the Subway burger are assembled fresh and customized. Build-to-order in this context refers to mass customization or hyper-personalization manufacturing model while retaining characteristics of high throughput and quality of traditional manufacturing.

As alluded in the retail example, the data, and insight from the point-of-customer-interaction can be used in upstream design. A number of other opportunities are emerging. Local Motors has demonstrated ability to 3D print a transportation vehicle (eg: Olli) in 10 hours, and assemble it in 11 hours (earlier cars like the Strati took 40+ hours to print). A lot of "local" factories could "parallelize" the 3D printing close to customer locations. Currently the vehicle is designed by a community open design challenge process, and finessed for direct digital manufacturing (DDM). Presumably in the future, based upon a template, users can directly interact with a 3D model in a store, and customize the car, and have a 3D printed fully personalized car delivered at their doorsteps similar to the timeframe they expect from something they order in Amazon.com.

While Local Motors represents a radical endpoint of personalization (batch size of 1), Industry 4.0 also is enabling smaller batch sizes with reconfigurable / flexible assembly lines for allow higher degrees of personalization, incorporating customer input at the time of order.

In the context of complex industrial products, a common problem is management of parts and servicing. Servicing can be aided on-site by augmented reality technologies that bring the knowledge base of the supplier, and the learnings over the past servicing, personalized to the operational context of the asset (as collected by the sensors on the asset). The inventory maintenance of costly parts (and associated maintenance regime) can be guided by the real-time risk rating (and condition/health) of the parts for a specific industrial asset. Provenance of parts, liability management, and service routing can be aided by a combination of Cognitive IoT and blockchain (eg: see example of provenance of diamonds that can be extended to Industry 4.0).

In the context of textile retailing, cognitive fashion can help re-envision the relationship between a textile mill and supplier, the end retailer and the customer (via smart textiles).Cognitive computing is helping designers craft new fashions, which can be shared quickly with consumers. A fashion dress maker can track consumer fashions much faster, and customize smaller batches. Stitch Fix is an example of a e-commerce site that personalizes designs based upon high level user requirements.

Summary:

Cognitive IoT can help manufacturing to get visibility into and capture efficiencies and service opportunities both downstream and upstream in the industrial value chains, in addition to operational and quality improvement of the manufacturing operation itself. The customer relationship and touch points can be managed in a personalized manner, and the voice/intent of the customer can drive deeper into the supply chain and manufacturing process. Several service and data monetization opportunities emerge as a natural consequence of hyper personalization and seamless human-machine interaction. We are clearly at early stages of how Cognitive IoT can impact Industry 4.0. Interesting times lie ahead!

This article was originally posted on LinkedIn.